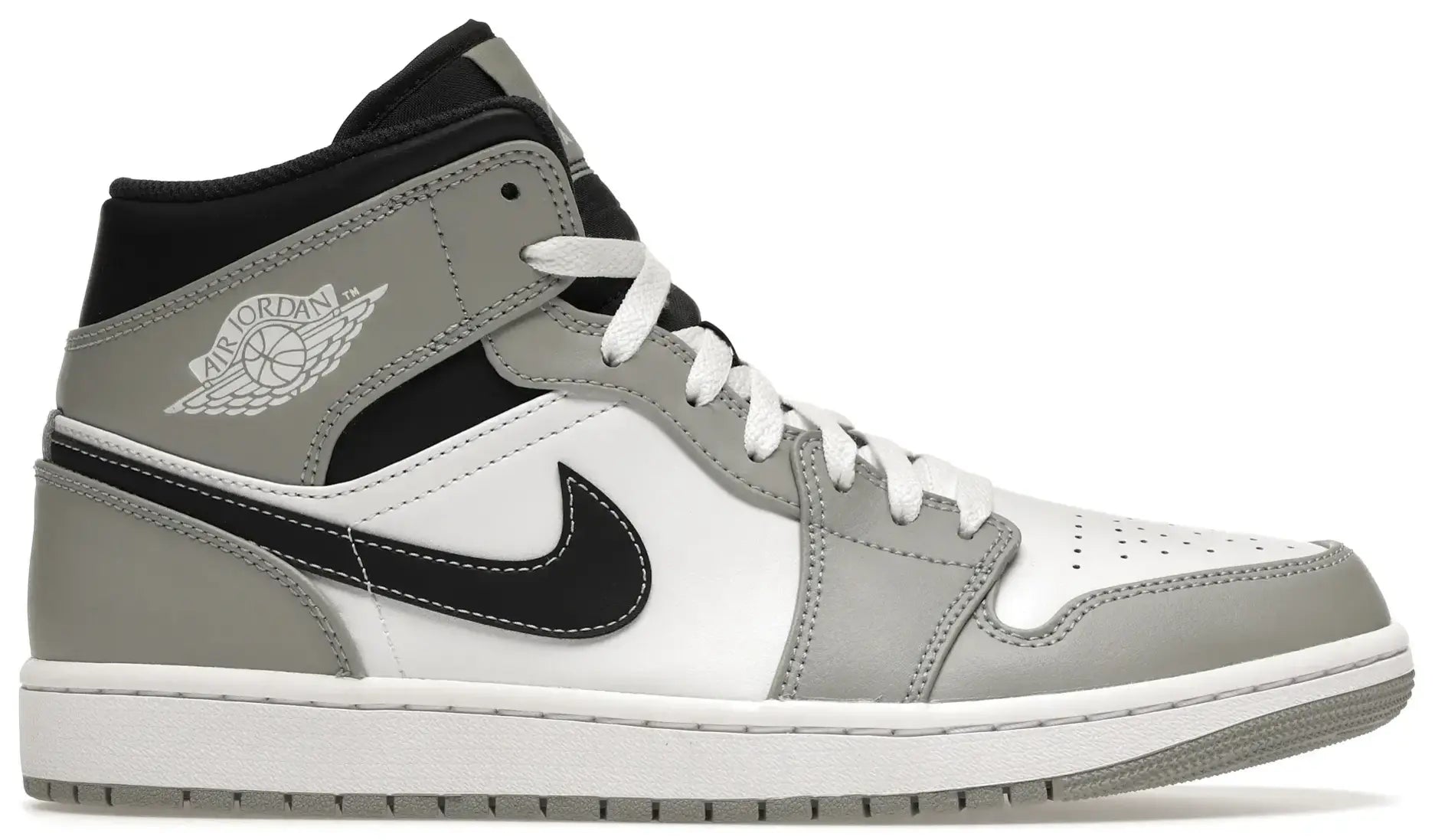

Sneakers as an investment

Investing in limited edition sneakers from brands like Nike, Jordan, or Adidas can be a very interesting opportunity for profit. This type of investment is based on several key principles:

Exclusivity and limited production: Sneakers that are released in limited quantities are often not re-released, and new pieces are not produced. This means that once all originally produced pieces are sold, no new ones will come to the market. As the popularity of the brand or model increases, their value can rise.

Reduced supply vs. increased demand: Once the number of available sneakers decreases while the interest from collectors and fans grows, prices can dramatically increase. High demand combined with low supply is a classic recipe for increasing value.

Special editions and collaborations: Sneakers that result from unique collaborations between brands and designers or celebrities can have particularly high collectible and investment potential. An example could be a collaboration between Nike and a popular artist or athlete.

Condition and preservation: The value of sneakers is significantly influenced by their condition. Sneakers that are kept in perfect condition and preferably in their original packaging tend to maintain or increase their value more than those that are damaged or worn.

Market sentiment and trends: Investing in sneakers can be highly influenced by current fashion trends and overall market sentiment. What is highly desirable today may not be tomorrow, and vice versa.

Sales platforms and authenticity: When trading limited edition sneakers, it is crucial to pay attention to the authenticity of the product. There are many platforms that offer authenticity verification, which can help maintain buyer trust and preserve the value of the investment.

Investing in limited edition sneakers can yield interesting returns, but like any investment, it carries risks. It is important to make informed decisions and carefully monitor the market to respond to changes in supply and demand.